Sure, you have a business plan; are you heavy on the idea and growth strategy and light on what first-year revenue and profit look like? STOP RIGHT THERE. You do not have enough information yet to figure out if you can afford to start and scale your business. With financial modeling, spend a few hours building your revenue and profit model – and we promise, it will change the trajectory of your business.

Before you can really understand the capital required to start and scale a business, and ultimately secure funding – through friends and family or VCs or another source – you need to be able to know when you will you start making money and how much.

Building Your Revenue Model

Before we started either of our businesses, we had built and rebuilt our revenue model a hundred times, each time pressure testing it, questioning our assumptions, and looking at our year-one expenses to see how long until we achieved break even. It gave us airtight confidence in what we would need to invest and what we could expect to take out of the business during the first year. Once we were comfortable with that model, we refined our execution plan to support it and managed it weekly.

Managing Cash Flow for Business Stability

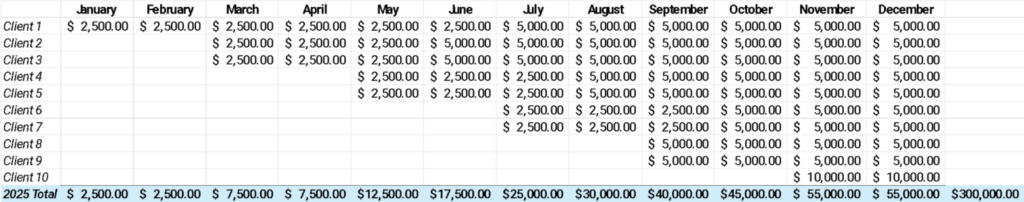

Now, for someone who has never built a revenue model before (i.e., Victoria 15 years ago), it is not as intimidating as it may sound. This “model” doesn’t have to be some multi-sheet, macro-heavy Excel document. It can be as simple as a monthly waterfall that reflects the expected impact on revenues – timing, amount and velocity – based on your sales and marketing efforts.

Below is a really basic version of the financial modeling exercise we used to create to forecast our annual revenues for our professional services business. We used this model to determine if we had a viable business, as we grew our business, as the basis for valuing the business when we sold it; and manage our segment once we were part of a larger company. It was our bible, so to speak, for creating value.

The Path to Break Even

Fairly, we had a significant amount of assumptions behind these waterfalls, as well as market research, sales data and seasonality trends that supported it, but in the very beginning, we started with what we knew. Our clients were mostly retained (recurring revenues), we had an average client retainer between $8K and $12K per month, and we knew it was a slow and steady build, i.e., not a tremendous amount of seasonality. As we added service lines, this became more complicated and we had more project work, which needed more analysis, but we always re-centered by tracking our progress by comparing actuals vs. this model. And, each year, when we began our strategic planning for the coming year, we looked at what we had learned – based on our financial modeling – for where we were right and where we were wrong.

Now…revenue is only one input, and an important one, but you also need to understand outflows to figure out how much money you will actually make. So, once we had a revenue model in place, we then turned to determining what an appropriate expense structure for us was – both initially and over the long-term as we grew the business.

For us, we are capitalists, so we needed to understand how quickly we would achieve breakeven. This was a non-negotiable for us – we were going to be in the black within the first year. As we got bigger, we were always looking to optimize our profitability. When you are modeling out your budget for year one, depending on the business you are in your expenses will look different, but we had a few rules that we lived and died by.

- We managed expenses against recurring revenues. Our business had project revenue, which was lumpy and often unpredictable, but in the right environment, it could be a big contributor to our top-line. That said, we kept our expense structure in-line with the predictable, recurring revenues of our retained business, and as a result, we had a consistent profitability.

- We were committed to being collectors first and business owners second, and we managed our cash flow like our life depended on it, which it did. First, client payment terms were critical in the contracting process. We focused on net-30 payments, i.e., clients had 30 days from receipt of the invoice to pay us. Then on the flip side, for our vendors, we typically pushed for net-45 payments, meaning we had to pay them 15 days after we received revenues from our clients. This allowed us to be slavish with our cash flow and maintain cash balances that would support our operating expenses for 2 months in the event something catastrophic happened.

- We always took it out of our own pocket first. In the early days, we would not take on additional debt to cover a new employee or big expense. Instead, we reduced our own compensation or distributions. If our personal take reached zero, then no more new hires until we generated more cash.

Financial modeling will help you create a revenue model AND a year-one P&L that shows your path to breakeven. Once you have these set, you are in a position to answer the other questions we posed to you – 1) Can you afford to start a business? 2) What do you need to fund the business? Both of these are critical before you ever can start looking for funding sources, and we will certainly dig into that more in the future, but right now, it’s time to get the numbers to back up your vision (and execution plan).